Accounting is the process of recording and summarizing financial transactions for businesses. It helps track income, expenses, and overall financial health.

Enter accounting: the behind-the-scenes hero that records financial transactions and paints a clear picture of a company’s financial health. It’s the language of business, guiding decisions and ensuring financial success

It is the systematic recording, analysis, and reporting of financial transactions for businesses. It provides essential insights for decision-making, budgeting, and ensuring compliance with regulations.

How Does Accounting Work?

Accounting works by systematically recording financial transactions, organizing them into categories, and summarizing them into financial statements. Initially, transactions like sales, purchases, and expenses are recorded in ledgers using double-entry bookkeeping, ensuring accuracy and balance. Then, these records are analyzed to create reports such as balance sheets, income statements, and cash flow statements, offering a clear overview of a company’s financial position.

These reports serve various purposes, aiding management in decision-making, fulfilling regulatory requirements, and providing insights into the company’s performance. Accountants play a crucial role in this process, ensuring that financial records are accurate, compliant, and transparent. Through accounting, businesses can effectively track their financial activities, identify areas for improvement, and make informed strategic decisions for future growth.

What Are the Principles of Accounting?

The principles of accounting are fundamental guidelines that govern the practice of recording financial transactions accurately. These principles include the principle of consistency, ensuring that accounting methods and practices remain uniform over time to enable meaningful comparisons. The principle of conservatism encourages accountants to err on the side of caution, preferring to understate rather than overstate assets and income.

The principle of materiality emphasizes the importance of reporting information that is relevant and significant to users of financial statements. This ensures that only material information that could impact decision-making is included in financial reports. Together, these principles uphold the integrity, reliability, and transparency of accounting information.

What Is the Purpose of Accounting?

The purpose of accounting is to track and organize financial information for businesses, aiding in decision-making and strategic planning. By summarizing financial transactions into clear reports, accounting enables management to assess the company’s financial health and performance accurately. Accounting plays a crucial role in ensuring compliance with regulatory requirements and providing transparency to stakeholders.

Moreover, accounting helps businesses secure funding by providing investors and lenders with reliable financial statements. These statements demonstrate the company’s profitability, liquidity, and overall financial stability. Ultimately, the purpose of accounting is to facilitate informed decision-making, promote financial accountability, and support the long-term success of businesses.

History of Accounting

Accounting has ancient roots, dating back to civilizations like Mesopotamia and Egypt, where rudimentary systems were used to track transactions. Luca Pacioli, an Italian mathematician, is often regarded as the “Father of Accounting” for his publication of a book on double-entry bookkeeping in 1494. Modern accounting emerged in the 19th century, formalized by organizations like the Institute of Chartered Accountants in England and Wales, spurred by the needs of merchants during the Industrial Revolution.

The Alliance for Responsible Professional Licensing (ARPL) was established in 2019, advocating for stringent requirements for professional accountants amidst deregulatory proposals. Today, accounting standards like GAAP in the U.S. and IFRS internationally guide financial reporting, ensuring consistency and transparency across industries.

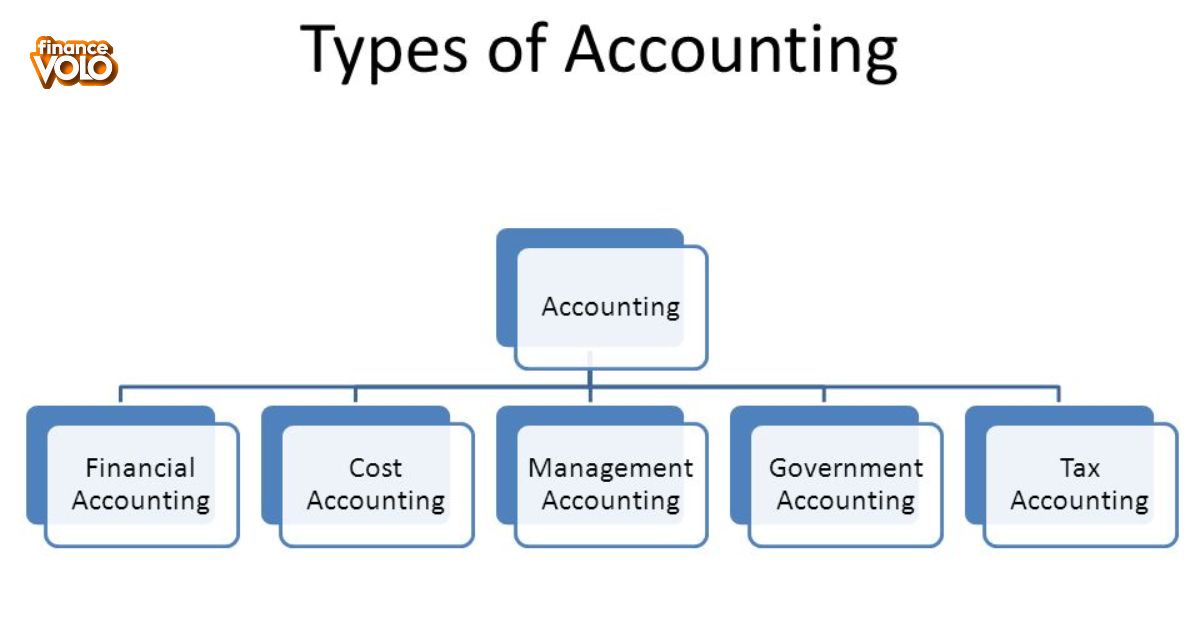

What Are the Different Types of Accounting?

Here are some types of Accounting

Financial Accounting

Financial accounting involves summarizing and reporting financial transactions to external stakeholders like investors and regulators. It provides a snapshot of a company’s financial health through key statements like the balance sheet and income statement. These reports are crucial for decision-making, assessing profitability, and ensuring transparency in the business world.

Managerial Accounting

Managerial accounting focuses on providing internal management teams with financial information to aid in decision-making and strategic planning. It involves analyzing budgets, forecasts, and various financial reports to help businesses optimize their operations and maximize profitability. Managerial accountants play a crucial role in helping management understand costs, identify areas for improvement, and make informed business decisions.

Cost Accounting

Cost accounting is a specialized branch of accounting focused on determining the costs associated with producing goods or services. It helps businesses make informed decisions about pricing, budgeting, and resource allocation by analyzing and tracking costs throughout the production process. By understanding the costs involved, companies can optimize their operations and improve profitability.

Tax Accounting

Tax accounting involves navigating complex regulations to ensure businesses comply with tax laws while minimizing their tax liabilities. It requires strategic planning and meticulous record-keeping to optimize financial outcomes. Tax accountants play a crucial role in guiding businesses through tax reporting, compliance, and strategic decision-making.

Project accounting

Project accounting is a specialized form of accounting that focuses on tracking financial transactions related to specific projects or tasks within a company. It helps businesses monitor project costs, budgets, and profitability by allocating expenses and revenues to individual projects. By providing insights into the financial performance of each project, project accounting enables businesses to make informed decisions and optimize resource allocation for future projects.

What Types of Careers Are in the Accounting Field?

In the accounting field, a range of career options cater to different interests and skill sets. Auditors are responsible for verifying financial records to ensure accuracy and compliance with regulations. They work both internally within organizations and externally with auditing firms.

Forensic accountants specialize in investigating financial discrepancies or fraud cases within companies or legal proceedings. Their expertise in financial analysis and investigative techniques helps uncover evidence and support legal actions. These professionals play a crucial role in maintaining the integrity and transparency of financial transactions.

What Are Accounting Standards?

Accounting standards are guidelines that ensure consistency and transparency in financial reporting. They help standardize accounting practices, making it easier for stakeholders to compare financial information across companies. These standards also provide a framework for preparing accurate and reliable financial statements.

In the United States, Generally Accepted Accounting Principles (GAAP) serve as the primary set of accounting standards. GAAP outlines the rules and procedures for recording and reporting financial information, ensuring uniformity in financial reporting practices. Similarly, International Financial Reporting Standards (IFRS) are used in many countries outside the U.S., providing a globally recognized framework for financial reporting.

What Are Major Accounting Software Platforms?

In the realm of accounting, major software platforms provide essential tools for managing financial data efficiently. QuickBooks, Quicken, and FreshBooks are popular choices for small businesses, offering user-friendly interfaces and essential features for bookkeeping and invoicing.

For larger enterprises, robust solutions like Oracle, NetSuite, and Sage offer comprehensive features to integrate with specific reporting needs and streamline complex financial processes. These platforms provide scalability and customization options to meet the diverse needs of medium to large-sized businesses.

What Is the Accounting Cycle?

The accounting cycle is a series of steps that businesses follow to process financial transactions and produce accurate reports. It involves collecting transaction data, posting entries to the general ledger, adjusting entries for accuracy, and ultimately preparing financial statements. This cycle ensures that financial information is recorded, organized, and analyzed effectively to support decision-making and ensure compliance with accounting standards.

Cash Method vs. Accrual Method of Accounting

Here are discussed about cash method vs. accrual method of accounting

| Aspect | Cash Method | Accrual Method |

| Recording Transactions | Records transactions when cash is exchanged. | Records transactions when they occur, regardless of when cash is exchanged. |

| Timing of Revenue | Recognizes revenue when cash is received. | Recognizes revenue when it is earned, regardless of when cash is received. |

| Timing of Expenses | Records expenses when cash is paid. | Records expenses when they are incurred, regardless of when cash is paid. |

| Complexity | Generally simpler and easier to understand. | Can be more complex due to timing differences between revenue recognition and cash receipts. |

| Compliance Requirements | Often preferred by small businesses and individuals. | Required for larger businesses and follows GAAP or IFRS standards. |

Top accounting software solutions

Discussed about top accounting software solutions in the following

QuickBooks Online

QuickBooks Online is a user-friendly accounting software used by businesses to manage their finances. It offers features like invoicing, expense tracking, and financial reporting. With its cloud-based platform, users can access their financial data anytime, anywhere, making it convenient for small businesses and self-employed individuals.

Xero

Xero is a popular accounting software platform designed for small businesses and freelancers. It offers user-friendly features for managing invoicing, expenses, and payroll. With Xero, users can track financial data efficiently and access real-time insights to make informed decisions.

Wave Accounting

Wave Accounting is a user-friendly accounting software designed for small businesses and freelancers. It offers features like invoicing, expense tracking, and financial reporting. With its intuitive interface and affordability, Wave Accounting helps users manage their finances efficiently without the need for extensive accounting knowledge.

Subscribe to the Daily Tech Insider Newsletter

Stay up-to-date with the latest in technology by subscribing to the Daily Tech Insider Newsletter. Get daily updates on tech news, trends, and innovations delivered straight to your inbox. Don’t miss out on important developments in the fast-paced world of technology – subscribe today!

Why Accounting Is Important

Accounting holds paramount importance in the business world for several reasons. It provides a clear snapshot of a company’s financial health, enabling informed decision-making by managers and investors. Secondly, accurate accounting ensures compliance with regulatory requirements, mitigating legal risks and fostering trust among stakeholders.

Moreover, accounting facilitates access to funding by providing lenders and investors with transparent financial statements. It also aids in strategic planning and forecasting, allowing businesses to anticipate challenges and capitalize on opportunities. In essence, accounting serves as the backbone of financial management, ensuring stability, transparency, and growth in the business landscape.

Related Post: How To Get Into Investment Banking

Example of Accounting

Here are some example of Accounting

- Double-entry accounting: Accounting transactions are recorded using the double-entry system, ensuring that each transaction affects two or more accounts.

- Financial reporting: Accounting involves preparing financial statements such as the balance sheet, income statement, and cash flow statement to summarize a company’s financial performance.

- Journal entries: Transactions are initially recorded in journals, where each entry includes a debit and a credit to maintain balance and accuracy.

- Ledger reconciliation: Accountants reconcile general ledger accounts to ensure that the balances match with supporting documentation and transactions.

- Auditing: Accounting records are subject to auditing by internal or external auditors to verify accuracy and compliance with accounting standards and regulations.

What Are the Responsibilities of an Accountant?

Accountants fulfill essential responsibilities in managing financial records and ensuring accuracy. They maintain detailed records of daily transactions and compile them into financial statements like balance sheets and income statements. They may conduct periodic audits to verify the accuracy of financial data and ensure compliance with regulatory standards.

Accountants also provide valuable insights and support for decision-making within organizations. They analyze financial data to identify trends, forecast future performance, and make strategic recommendations to management. By offering expertise in financial analysis and reporting, accountants contribute to the overall financial health and success of businesses.

What Skills Are Required for Accounting?

In the field of accounting, certain skills are essential for success in various roles. Attention to detail is crucial, as accountants must accurately analyze and record financial data without overlooking any discrepancies. Logical thinking skills aid in problem-solving, helping accountants navigate complex financial situations and identify solutions efficiently.

Proficiency in communication is important for accountants to effectively convey financial information to stakeholders. Whether presenting reports to management or collaborating with colleagues, clear communication ensures understanding and facilitates informed decision-making. Moreover, adaptability is key in accounting, as professionals must stay updated on evolving regulations and technological advancements to maintain accuracy and efficiency in their work.

Why Is Accounting Important for Investors?

Accounting is vital for investors as it provides crucial insights into a company’s financial health and performance. By analyzing financial statements like balance sheets and income statements, investors can assess profitability, liquidity, and overall stability before making investment decisions.

Its ensures transparency and accountability, giving investors confidence in the accuracy and reliability of financial information. This helps mitigate risks and enables investors to make informed choices, contributing to a more efficient and trustworthy financial market ecosystem.

Ways To Manage Your Business Accounting

So far, we’ve seen the types and benefits of accounting. This leads us to the Question of knowing how to carry out accounting efficiently. There are many ways to manage your business accounting. They include

Outsource to Professionals

Outsourcing to professionals involves hiring external experts to handle specific tasks or functions for a business. This can include accounting, IT support, customer service, or marketing. Outsourcing allows businesses to focus on their core activities while benefiting from specialized expertise and cost savings.

Using Accounting Software

Using accounting software streamlines financial record-keeping tasks for businesses. It automates processes such as invoicing, expense tracking, and financial reporting, saving time and reducing errors. With user-friendly interfaces, accounting software enables even non-accounting professionals to manage finances effectively.

Hiring an In-House Accountant

Hiring an in house accountant offers several benefits for businesses. They provide dedicated support for financial tasks, including bookkeeping, payroll, and tax preparation, ensuring accuracy and compliance. With an in-house accountant, businesses can access timely financial insights and personalized guidance to make informed decisions for growth and success.

Related Post: what is apy in banking?

Frequently Asked Questions

What is the purpose of accounting?

The purpose of accounting is to record, summarize, analyze, and report financial transactions for businesses to make informed decisions, ensure compliance, and assess financial performance.

What are the main types of accounting?

The main types of accounting include financial accounting, which focuses on external reporting; managerial accounting, used for internal decision-making; cost accounting, analyzing production costs; and tax accounting, ensuring compliance with tax laws.

What careers are available in the accounting field?

Careers in accounting include auditors, forensic accountants, tax accountants, managerial accountants, information technology analysts, and controllers, offering diverse roles and responsibilities.

Why is accounting important for businesses?

Accounting is essential for businesses to track financial transactions, assess performance, make strategic decisions, ensure compliance with regulations, attract investors, and manage finances effectively.

What are some common accounting software platforms?

Common accounting software platforms include QuickBooks, Xero, FreshBooks, Sage 50, NetSuite, and Oracle, offering various features tailored to the needs of businesses of different sizes and industries.

Related Post: What Does Ach Stand For In Banking?

Final Words

Accounting is the systematic process of recording, summarizing, analyzing, and reporting financial transactions for businesses. It serves crucial purposes such as aiding decision-making, ensuring compliance with regulations, and assessing a company’s financial health.

Within the accounting field, various career paths offer opportunities for diverse roles and responsibilities. These include auditors, forensic accountants, tax accountants, managerial accountants, and information technology analysts, each contributing to different aspects of financial management and reporting.