ACH stands for Automated Clearing House in banking. It’s a system for electronic funds transfers between banks in the United States, facilitating direct deposits, bill payments, and other transactions.

Its clearing House, the engine driving electronic money transfers in the U.S. With over 10,000 participating institutions, it’s the digital highway for direct deposits, bill payments, and more, making financial transactions fast and convenient. Dive into the world of ACH to uncover how it simplifies your banking experience

All About the Automated Clearing House

The Automated Clearing House (ACH) is the backbone of electronic money transfers in banking. It connects over 10,000 banks and financial institutions, enabling seamless transactions like direct deposits and bill payments. ACH operates as a digital hub, facilitating the movement of funds between individuals, businesses, and governments.

This system processes billions. Of payments annually, ensuring efficiency and reliability in money movement. With transactions occurring in batches throughout the day, ACH provides a secure and convenient way to transfer funds electronically.

How ACH Payments Work

ACH payments work through a simple and secure process. Firstly, the originator initiates the transaction by sending a request to their bank or financial institution. Then, the transaction is forwarded to an ACH operator, which routes it to the Receiving Depository Financial Institution (RDFI), where the funds are deposited into the receiver’s account.

Both parties must authorize these transactions, ensuring security and reliability. Whether it’s paying bills or receiving paychecks, ACH payments offer a convenient and automated way to transfer funds electronically, streamlining financial transactions for individuals and businesses alike.

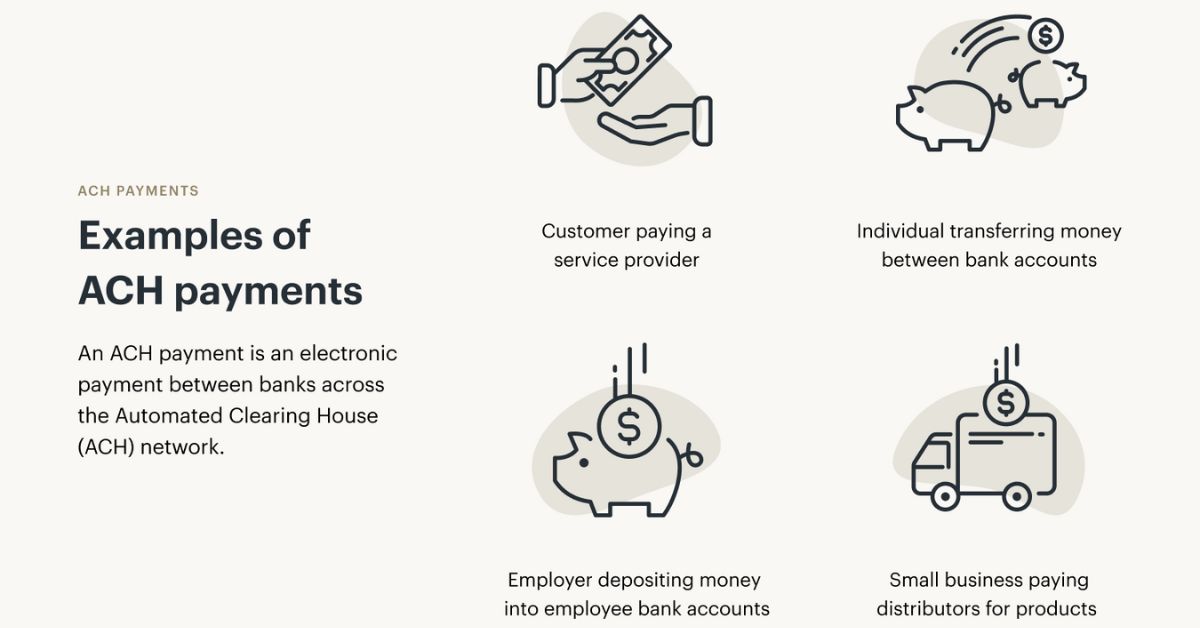

Examples of An ACH Payment

- ACH Debit: Involves pulling funds directly from an account, such as setting up recurring mortgage payments.

- ACH Credit: Involves moving funds into an account, like transferring funds from a payment app to a bank account.

- ACH Direct Deposit: Occurs when funds are directly deposited into an account, such as receiving a paycheck electronically.

Benefits of the ACH Network

The ACH Network offers numerous benefits for individuals and businesses alike. Firstly, electronic transactions through ACH are fast, efficient, and reliable, providing a seamless way to transfer funds without processing fees. Electronic payments streamline record-keeping, eliminating the need for physical documents and reducing the risk of fraud.

Moreover, automation is a key advantage of the ACH Network, ensuring payments arrive on time and reducing the likelihood of missed bills. For businesses, ACH payments simplify transaction management and encourage faster and more regular payments from consumers. Overall, the ACH Network provides a cost-effective, secure, and convenient solution for electronic fund transfers.

Drawbacks of the ACH Network

Users must provide their account information for authorization, increasing the risk of overdrawing accounts or unauthorized transactions. Businesses may face challenges with unexpected withdrawals or errors due to the direct link to their bank accounts.

There are costs associated with participating in the ACH Network, including annual fees and transaction fees for banks and financial institutions. Plus, larger businesses may have to invest in time and software to enable ACH transfers, adding to operational expenses. Despite these drawbacks, the ACH Network remains a widely used and valuable tool for electronic fund transfers.

Tips for Managing Your Money

Here are some tips for managing your money

Invest Wisely

Investing wisely involves making informed decisions to grow your money beyond traditional savings accounts. By diversifying your investments across different asset classes, such as stocks, bonds, and real estate, you can spread risk and potentially increase returns. Researching investment options and seeking advice from financial professionals can help you make smart choices that align with your financial goals.

Consult a Financial Advisor

Consulting a financial advisor can provide valuable insights into managing your finances effectively. With their expertise, you can develop personalized strategies to achieve your financial goals. Whether you’re planning for retirement, saving for a big purchase, or investing for the future, a financial advisor can offer guidance tailored to your individual needs.

Shop Around for Banking

When it comes to banking, don’t settle for the first option you find. Explore various banks to find the best fit for your needs, considering factors like interest rates and account features. By shopping around, you can maximize your savings and ensure your banking experience aligns with your financial goals.

Consider Online Banking

Embrace the convenience of online banking, which allows you to manage your finances from the comfort of your home. With features like 24/7 account access and mobile banking apps, online banking makes it easy to check balances, pay bills, and transfer funds on the go. Plus, online security measures ensure your transactions are safe and secure.

Automate Your Finances

Automate your finances to simplify your life and ensure bills are paid on time. By setting up automatic payments and transfers, you can streamline your financial tasks and avoid late fees. This approach also helps you consistently contribute to savings or investments, building wealth over time.

What do you want to do with money?

Money serves as a means to fulfill various needs and desires in life. Primarily, it enables individuals to cover essential expenses like housing, utilities, and groceries, ensuring a basic standard of living. Beyond meeting basic needs, money empowers people to pursue their aspirations and dreams, whether it’s starting a business, furthering education, or supporting loved ones. Ultimately, the choices people make with their money reflect their priorities and values, shaping their present circumstances and future prospects.

Moreover, money provides a sense of security and stability in an unpredictable world. Accumulating savings and investments offers a financial safety net, providing reassurance during emergencies or unforeseen circumstances. Beyond mere survival, financial resources afford individuals the freedom to make choices that align with their aspirations and values, fostering a sense of autonomy and control over their lives.

What Does ACH Stand For in Banking Terms?

ACH, short for Automated Clearing House, is the digital highway for money transfers among financial institutions. It simplifies processes like direct deposits and bill payments, enhancing convenience for both individuals and businesses. Essentially, ACH acts as the invisible hand behind electronic fund movements, ensuring seamless transactions.

This system, managed by over 10,000 banks and financial institutions, processes billions of payments annually. Its efficiency and reliability make it a preferred method for various financial transactions, from payroll processing to vendor payments. In essence, ACH facilitates the swift and secure transfer of funds, shaping the modern landscape of banking and finance.

Types of ACH Transactions

- ACH Debit: Involves pulling funds directly from an account, commonly used for recurring payments like mortgages or utility bills.

- ACH Credit: Involves pushing funds into an account, often used for direct deposits such as payroll or tax refunds.

- ACH Direct Deposit: Occurs when funds are electronically deposited into an individual’s account, commonly used for employee paychecks.

- ACH Payments: Include various types of electronic payments, such as person-to-person transfers, vendor payments, and online bill payments.

- ACH Transfers: Enable individuals and businesses to move funds between accounts at different financial institutions electronically, providing a convenient and cost-effective way to manage finances.

Credit Unions vs. Banks – Differences, Pros & Cons

Credit unions and banks each have their own distinct characteristics and advantages. Credit unions, owned by their members, often offer lower fees and higher interest rates on savings accounts, but they may have more limited branch and ATM networks. Credit unions tend to prioritize personalized customer service and may be more willing to work with members who have less-than-perfect credit.

On the other hand, banks, typically owned by shareholders, offer a wider range of financial products and services and have more extensive branch and ATM networks. While banks may have higher fees and lower interest rates on savings accounts, they often provide more advanced digital banking options and may offer greater convenience for customers who frequently travel or need access to specialized financial services.

Automatic Bill Payment Plans – Advantages & Disadvantages

Automatic bill payment plans offer convenience by automatically deducting funds from your account to pay bills on time, saving you time and ensuring you never miss a payment. However, they can lead to overspending if you’re not mindful of your budget, and there’s a risk of overdraft if you don’t have enough funds in your account when payments are processed.

Difference Between Credit Cards vs Debit Cards

Here are some difference between credit Cards and debit Cards

| Aspect | Credit Cards | Debit Cards |

| Source of Funds | Borrowed money from issuer up to a credit limit | Directly linked to your bank account |

| Payment Responsibility | Requires repayment of borrowed amount with interest | Uses funds already available in your bank account |

| Debt Accumulation | Can lead to accumulating debt if not managed properly | No debt accumulation as spending is limited to available funds |

| Overdraft Protection | Generally not provided | May offer overdraft protection with associated fees |

| Rewards and Incentives | Often offer rewards, cashback, or travel points | Rarely offer rewards or incentives for spending |

| Fees | May have annual fees, late fees, and interest charges | Typically have fewer fees, but may include ATM or overdraft fees |

| Credit Score Impact | Can impact credit score positively or negatively | Does not impact credit score as there’s no borrowing involved |

Frequently Asked Questions

What does ACH stand for?

ACH stands for Automated Clearing House.

What is the purpose of ACH in banking?

ACH facilitates electronic money transfers and automatic payments between banks and financial institutions.

How does ACH work?

ACH works by processing electronic transactions in batches, allowing for direct deposits, bill payments, and other transfers between accounts.

Are there different types of ACH transactions?

Yes, common ACH transactions include ACH Debit, ACH Credit, and ACH Direct Deposit.

What are the benefits of using ACH?

Using ACH is fast, efficient, and reliable, with lower fees compared to other transaction methods. It also enables automated payments and simplifies record-keeping.

Related post: what is apy in banking?

Final Words

ACH stands for Automated Clearing House, serving as the backbone of electronic money transfers in banking. It facilitates various transactions like direct deposits, bill payments, and tax refunds between banks and financial institutions. Essentially, ACH streamlines the process of moving funds electronically, making financial transactions efficient and convenient for individuals and businesses alike.

Managed by over 10,000 banks and financial institutions, the ACH system processes billions of payments annually, ensuring efficiency and reliability. Its widespread use and secure processes make it a preferred method for various financial transactions, from payroll processing to vendor payments. In essence, ACH facilitates the swift and secure transfer of funds, shaping the modern landscape of banking and finance.