Dealing with financial accounts, understanding the precise account naming conventions is crucial. Your bank account name is more than just a label; it’s an essential piece of information that facilitates accurate transactions, transfers, and record keeping.

In this comprehensive guide, we’ll dive deep into the world of bank account names, exploring their components, importance, and best practices.

Key Takeaways

- Your bank account name typically consists of your full legal name, along with additional numerical and alphabetical identifiers specific to your account type and bank.

- Account names are critical for ensuring seamless financial activities like deposits, withdrawals, payments, and transfers.

- Common account name formats include personal names for individual accounts, business names for commercial accounts, and a combination of names for joint accounts.

- Providing the correct account name is essential to avoid delays, errors, or misdirected transactions.

What Is The Account Name For a Bank Account?

At its core, your bank account name is the unique identifier assigned to your specific financial account by your banking institution. This name serves as a crucial reference point for all account-related activities, including deposits, withdrawals, transfers, and recordkeeping.

While the account name may seem like a simple detail, it plays a vital role in ensuring the accuracy and smooth functioning of your financial transactions. Essentially, the account name is how your bank distinguishes your account from millions of others and correctly routes funds to the intended destination.

Typical account name formats can vary slightly between banks, but they generally follow a standardized structure that includes:

- The account holder’s full legal name (for individual accounts) or business name (for commercial accounts).

- Additional numerical identifiers, such as account numbers or codes.

- Alphabetical identifiers indicating the account type (e.g., checking, savings, joint).

For example, a personal checking account name might appear as John A. Doe – 012345678 Personal Checking.

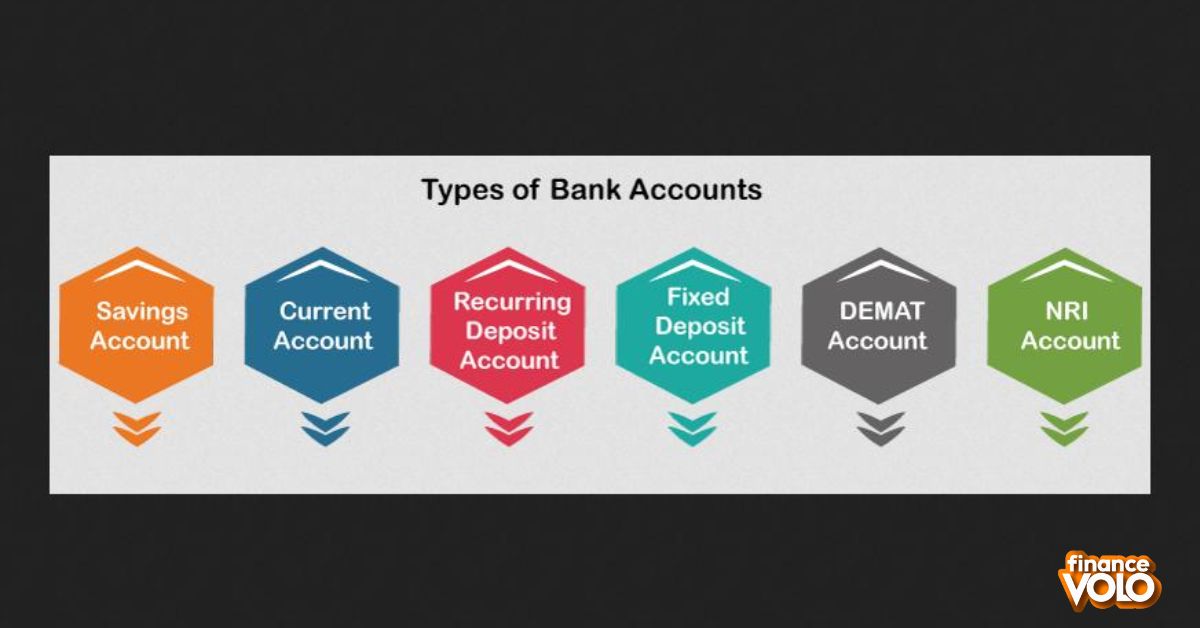

Different Types of Bank Accounts in the US

While the fundamental principles of account names remain consistent across various account types, there are some nuances to be aware of depending on the specific account you hold.

Personal Checking Accounts

For individual checking accounts (often referred to as “current accounts” in some regions), the account name typically follows a straightforward format that includes:

- The account holder’s full legal name (first, middle, and last name).

- An account number or code assigned by the bank.

- An identifier specifying the account type (e.g., “Personal Checking”).

Example: Jane M. Doe – 987654321 Personal Checking

Savings Accounts

Savings account names follow a similar structure to checking accounts, with the primary difference being the account type identifier. These accounts are designed for holding and accumulating funds over time, rather than frequent transactions.

Example: John A. Doe – 012345678 Savings

Joint Accounts

Joint accounts, which are shared between two or more individuals, incorporate the names of all account holders into the account name. The order of names may vary based on the bank’s policies or the primary account holder’s preference.

Example: Jane M. Doe & John A. Doe – 567890123 Joint Checking

Business Accounts

For commercial entities such as corporations, limited liability companies (LLCs), or sole proprietorships, the account name reflects the registered business name rather than personal names.

Example: Acme Widgets Inc. – 234567890 Business Checking

Components of a Bank Account Name

While account name formats can vary slightly across institutions, they generally consist of the following components:

- Account Holder Name(s): This is the most prominent part of the account name and includes the full legal name(s) of the individual(s) or business associated with the account.

- Account Number: A unique numerical identifier assigned by the bank to distinguish your account from others within their system.

- Account Type Identifier: An alphabetical code or descriptor that specifies the type of account, such as Checking Savings Joint, or Business.

- Additional Identifiers: Some banks may include additional codes, branch numbers, or other identifiers within the account name for internal tracking purposes.

- Separators: Account names often use spaces, hyphens, or other separators to delineate the different components for improved readability and clarity.

It’s important to note that while account numbers are typically included within the account name, they are distinct from your bank routing number, which identifies the specific financial institution.

How to Find Your Account Name

If you’re unsure of your account name or need to verify its accuracy, there are several places you can locate this information:

- Bank Statements: Your monthly or quarterly bank statements will prominently display your account name, usually at the top or within the header section.

- Online Banking Portal: Log into your bank’s online banking platform, and your account name should be clearly visible within your account details or summary.

- Checks: For checking accounts, your account name is typically printed on the bottom of your physical checks.

- Bank Correspondence: Any official letters, notices, or other communications from your bank will likely include your full account name as a reference.

- Contact Your Bank: If you’re still unable to locate your account name, you can always reach out to your bank’s customer service department, and they’ll be able to provide you with the correct information.

Importance of Correct Account Names

While it may seem like a minor detail, ensuring the accuracy of your account name is crucial for several reasons:

- Facilitating Transfers and Payments: Providing the correct account name is essential for ensuring that funds are transferred or deposited into the intended account. Errors in account names can lead to delays, misdirected transactions, or even funds being sent to the wrong recipient.

- Avoiding Fees and Penalties: Some banks may impose fees or penalties if transactions are unsuccessful due to incorrect account name information, as it can create additional administrative overhead.

- Maintaining Accurate Records: Precise account names are vital for maintaining accurate financial records, both for personal bookkeeping and regulatory compliance purposes (especially for businesses).

- Preventing Fraud and Misuse: Clearly identifying account names helps mitigate the risk of fraudulent activities or unauthorized access to your financial accounts.

In essence, taking the time to verify and provide the correct account name can save you from potential headaches, delays, and financial consequences down the line.

Common Mistakes to Avoid When Entering Account Names

Even with the best intentions, it’s easy to make seemingly minor mistakes when entering account names, which can have significant consequences. Here are some common pitfalls to avoid:

- Excluding Name Prefixes or Suffixes: Ensure that you include any applicable name prefixes (e.g., Mr., Mrs., Dr.) or suffixes (e.g., Jr., Sr., III) when entering account names, as these can be crucial identifiers.

- Character Limits: Some banks or financial platforms may impose character limits on account names, so be mindful of truncating or abbreviating names in a way that could lead to confusion or inaccuracies.

- Transcription Errors: Double-check that you’ve accurately transcribed account names, especially when dealing with long names or alphanumeric combinations. Even a single typo or transposed character can lead to issues.

- Inconsistent Formatting: Maintain consistent formatting for account names across different platforms, documents, or transactions. Inconsistencies in spacing, capitalization, or separator usage can cause discrepancies.

- Outdated Information: Ensure that you’re using the most current account name information, as names may change due to events like marriage, legal name changes, or business restructuring.

Minimize the risk of errors, it’s always a good practice to double-check account names against official sources, such as bank statements or online account portals, before entering them for any financial transactions or activities.

In conclusion, understanding the account name for your bank account is more than just a formality. It’s a crucial piece of information that facilitates accurate financial transactions, record keeping, and regulatory compliance. By grasping the components of account names, the importance of correct entries, and the common pitfalls to avoid, you can ensure a seamless banking experience and maintain control over your financial affairs.

Remember, if you ever have doubts or questions about your account name, don’t hesitate to reach out to your banking institution’s customer service representatives. They’ll be more than happy to provide you with the correct information and guidance to keep your financial activities running smoothly.

Case Study: The Consequences of an Incorrect Account Name

To illustrate the potential ramifications of providing an incorrect account name, let’s examine a hypothetical case study:

Scenario

Alice is attempting to transfer $5,000 from her checking account to her son Bob’s savings account as a gift for his upcoming wedding. When entering Bob’s account name, Alice accidentally transposes two characters in his middle initial.

Result

The bank’s automated systems are unable to locate a matching account with the incorrect name provided. As a result, the transfer is rejected, and the $5,000 remains in Alice’s account.

Alice is initially unaware of the issue until Bob contacts her a week later, inquiring about the missing funds. By this time, the wedding celebrations have already taken place, and Bob had been counting on that money for associated expenses.

Resolution

After several phone calls with the bank and some investigation, the source of the error is identified as the incorrect account name entry. Alice is able to re-initiate the transfer with the proper account name details, but the delay has already caused significant inconvenience and stress for both parties.

This case study highlights how a seemingly minor mistake in an account name can lead to unintended consequences, delays, and potential financial strain. While this particular scenario was ultimately resolved, such errors can sometimes result in more severe repercussions, such as funds being misdirected to the wrong recipient or incurring fees and penalties from the bank.

Quotes on the Importance of Accurate Information

To further emphasize the significance of accurate account name details, here are some relevant quotes from financial experts and industry professionals:

In the financial world, precision is paramount. A single incorrect digit or misplaced character in an account name can have ripple effects that disrupt the entire transaction process. Sarah Johnson, Certified Financial Planner

Attention to detail is crucial when dealing with account names and other sensitive financial information. A momentary lapse in concentration can lead to costly mistakes and headaches down the line.Michael Thompson, Bank Vice President

Ensuring the accuracy of account names is a shared responsibility between financial institutions and their customers. By working together and double-checking details, we can minimize errors and maintain a smooth flow of transactions. Emily Davis, Banking Ombudsman

These quotes reinforce the notion that accurate account name information is not just a formality but a critical component of maintaining a well functioning financial system, fostering trust, and providing a positive customer experience.

Simplifying Account Names: Potential Solutions

While the importance of correct account names cannot be overstated, there are ongoing efforts within the banking industry to simplify and streamline account naming conventions. Some potential solutions being explored include:

- Unique Account Identifiers: Instead of relying solely on names, which can be prone to errors and inconsistencies, some institutions are exploring the use of unique, system generated account identifiers that are independent of an individual’s name or business entity.

- Biometric Authentication: With advancements in biometric technologies like fingerprint, facial, or voice recognition, account access and verification could potentially be tied to these unique identifiers rather than relying on manually entered account names.

- Standardized Naming Conventions: Efforts are underway to establish more standardized account naming protocols across the financial industry, reducing variations and ambiguities that can contribute to errors.

- Automated Name Validation: Banks are implementing more robust automated systems to validate entered account names against their databases, flagging potential discrepancies or errors before transactions are processed.

While these solutions are still in various stages of development and implementation, they represent a proactive approach by the financial sector to address the challenges associated with account naming and further enhance the security, accuracy, and efficiency of financial transactions.

By combining technological advancements with clear communication and educational efforts for customers, the industry aims to strike a balance between simplicity and ensuring the proper safeguards are in place for protecting sensitive financial information.

In-Depth: Dissecting a Complex Account Name

To further illustrate the various components of an account name, let’s break down a more intricate example:

Account Name: Johnson & Associates LLP – 75492011 Business Checking – Branch 2345

In this case, the account name consists of the following elements:

- Account Holder Name: Johnson & Associates LLP- This is the registered business name for a limited liability partnership.

- Account Number: 75492011 The unique numerical identifier assigned by the bank to this specific account.

- Account Type: Business Checking This indicates that the account is a commercial checking account used for regular business transactions.

- Additional Identifier: Branch 2345 Some banks include a branch or location code within the account name for internal tracking and processing purposes.

This comprehensive account name provides multiple layers of information, allowing the bank to accurately identify the account holder, account type, and specific branch or location associated with the account.

It’s worth noting that while this example includes several components, not all account names will necessarily be this detailed. The level of complexity can vary depending on the bank’s internal protocols and the specific account type.

Understanding the potential components that can make up an account name is valuable knowledge, as it can help account holders ensure they are providing complete and accurate information when needed, minimizing the risk of errors or delays in financial transactions.

Frequently Asked Questions

What is the account name for a bank account

The account name for a bank account is the name under which the account is registered.

Can the account name be different from my own name?

Yes, it’s possible for the account name to be different, especially for joint accounts or accounts held under a business name.

Why is the account name important?

The account name is crucial for identifying the rightful owner of the funds in the account and ensuring secure transactions.

Can I change the account name?

In most cases, you can change the account name by providing the necessary documentation and following the bank’s procedures.

What happens if the account name doesn’t match the name on a transaction?

If the names don’t match, the transaction may be flagged for security reasons, and the bank may request additional verification to ensure the transaction’s legitimacy.

Conclusion

In the ever evolving landscape of banking and finance, understanding the intricacies of account names may seem like a minor detail but it carries significant weight. Throughout this comprehensive guide we’ve explored the nuances of account names, their components, importance and the potential consequences of inaccuracies.

Ultimately, the account name serves as a unique identifier that facilitates seamless financial transactions, accurate record keeping, and regulatory compliance. By grasping the principles of account naming conventions, you empower yourself to navigate the financial world with confidence and precision.

Remember, attention to detail is paramount when dealing with account names. Even a single mistyped character or overlooked prefix can lead to delays misdirected funds, or potential penalties. Take the time to double check and verify your account name details against official sources, such as bank statements or online portals, to ensure accuracy.